What is Operating Leverage?

Operating leverage is a concept in business finance that describes an organization’s ability to take advantage of its fixed costs and make them productive. Basically, fixed costs are the ones a business incurs when it conducts its operations. Fixed costs are expenses that don’t change with output levels, such as rent and salaries. In contrast, variable costs are incurred according to the amount of output produced, such as the cost of raw materials or utilities used in production.

Operating leverage is a concept used to evaluate how efficiently a company uses its assets to generate revenue and profit. So, when incremental sales go up, the fixed costs will remain the same. In this case, the company’s profit might double or triple with the same fixed costs.

The break-even point of a business is determined using operating leverage, which also aids in determining the right selling prices to cover all expenditures and make a profit.

Regardless of whether they sell any units of product, businesses with significant operational leverage must cover a bigger amount of fixed costs each month. Airlines is one such sector that comes with a high fixed cost, such as the cost of the aircraft, hangers, and insurance. As a result, their operating leverage is also high. While the company may increase their profits with the fixed costs, these companies are susceptible to recession and are heavily impacted when the economy is on a downward trend.

Low-operating-leverage businesses may have high variable costs directly related to sales but also have fewer monthly fixed expenses. Service-based companies are companies that have a higher variable cost and come with lower operating leverage. These companies have the flexibility to increase or decrease their variable costs per the economic scenarios.

How to Calculate Operating Leverage

Operating leverage is calculated by dividing operating income by the percentage change in sales. Operating income is the profit after paying for the direct operating costs, including fixed and variable costs.

Here’s the formula for operating income: Net Income – Operating costs.

One can easily find the operating income from the company’s income statement

Change in the operating leverage is expressed as a ratio and called the degree of operating leverage(DOL). The higher the operating leverage, the more earnings will change for every small percentage change in revenue.

So, the formula of operating leverage is

%Change in Operating Income/ % change in contribution/ sales

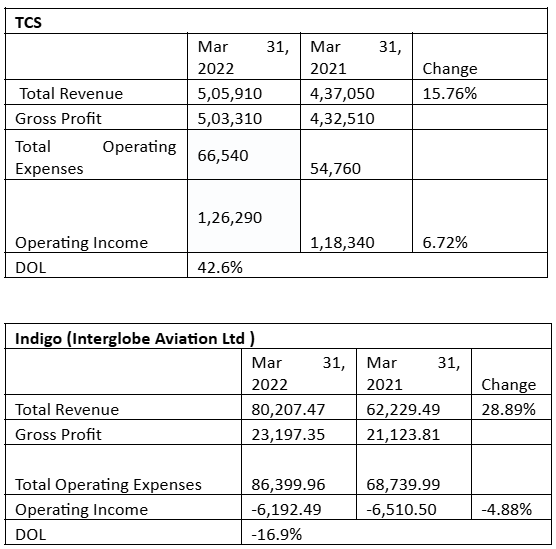

Let us see this with the help of an example. We are considering two companies: Indigo, an airline-based company and TCS, an IT company.

We have included the required data from the companies’ income statements.

To calculate the DOL, we divided the change in operating income by the change in revenue/sales.

As you can see, there is a range of possibilities for operating leverage. Positive leverage shows that the business is outpacing its costs with sales. Negative leverage, on the other hand, shows that the business is not making enough money to pay the various costs.

High and Low Operating Leverage

Due to the fact that certain industries have higher fixed costs than others, it is crucial to evaluate operating leverage between businesses in the same sector. The idea of a high or low ratio is then explained in greater detail.

In general, higher operating leverage is better than low leverage since it helps companies to generate more profits from every sale. But with smaller sales volumes, companies with minimal operating leverage may have a better chance of making a profit. Additionally, businesses with a high level of operating leverage may be more vulnerable to changes in revenue.

In a strong economy, businesses might make more money. However, due to their high fixed costs, an economic downturn could result in a decline in profits.

High Operating Leverage

Excessive operating leverage typically results in a significant portion of a company’s expenses being fixed costs.

In this instance, every additional sale generates a profit for the company. It must, however, generate enough revenue to cover the high fixed costs.

If the corporation achieves this, it will imply that the entity in charge of its business operations will be able to generate lots of revenue after paying for all of its fixed costs.

In these situations, the earnings are more sensitive to changes in the volume of sales.

Low Operating Leverage

This indicates lower fixed expenses and higher variable costs. In this scenario, a business must generate a minimum amount of sales to cover its fixed costs. When it reaches the point where all of its fixed costs are met, it becomes profitable.

It can gain incremental profit in terms of Selling Price minus the Variable Cost once it has reached the break-even point, where all of its fixed expenses are covered. However, this profit won’t be significant because the variable costs are so high.

We may fairly assume that the break-even units a company needs to sell to experience a no loss and no profit equation will be significantly smaller when operating leverage is low and fixed expenses are lower.

Difference between the degree of operating leverage and degree of combined leverage

Financial leverage is when a company uses debt in its capital structure and has to pay interest on that debt.

A degree of combined leverage (DCL) is a leverage ratio that shows how the degree of operating leverage (DOL) and the degree of financial leverage(DFL) affect earnings per share (EPS) when sales change in a certain way.

Combined Leverage Formula = %Change in EPS/% Change in sales = DOL*DFL