Investing in Mutual Funds vs Stocks Which is Better? Stocks and mutual funds are the most popular form of equity investing especially among retail investors.

Mutual Funds collect money from various investors and invest the amount in a diversified portfolio of equity shares, bonds, and other assets. Investing directly in stocks can be done simply through a demat account. For a complete beginner with no prior experience, investing in mutual funds may be a good choice. But, for those wanting higher returns investing directly in stocks can be a better alternative.

Now, choosing between stocks and mutual funds involves a couple of factors like risk tolerance, long-term investment goals, market expertise, etc. This article compares both so you can decide which one is the better investment option for you.

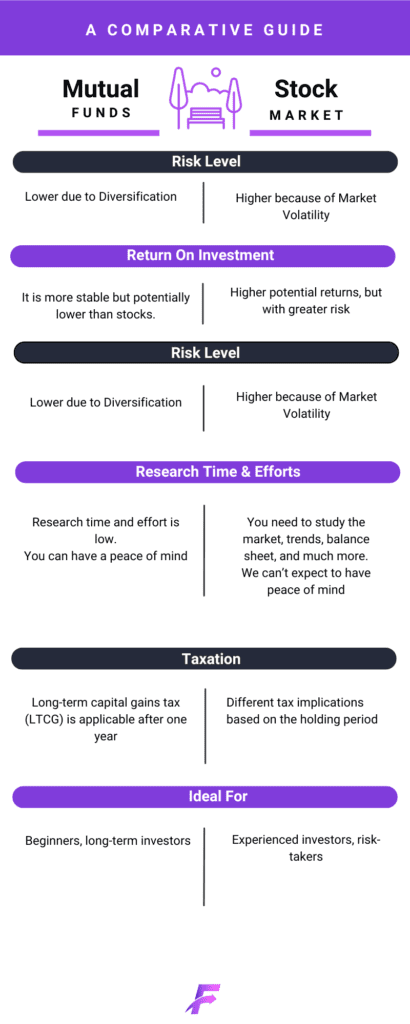

Key Differences Between Mutual Funds and Stocks

Both mutual fund investing and stock trading have their benefits and risks. The table given below contains a detailed comparison between the two:

Investing in Mutual Funds vs Stocks: Risk and Return Comparison

Both mutual funds and stocks cater to investors with different tolerance for risk. Mutual Fund investors can expect decent returns while being stable on the risk spectrum. stocks on the other hand cater to investors who can tolerate big risks and drawdowns on their portfolios. They can give multifold returns over the years but also come with huge downside risks. The various parameters to consider are mentioned below.

1. Risk

Direct investment in stocks is very risky as the share prices can fluctuate heavily due to the company’s performance, economic conditions, and government regulations.

Mutual funds are less risky simply because of the diversification factor involved.

To invest in stocks directly one will need to have extensive knowledge of the equity markets along with a thorough analysis of the associated company.

2. Returns

Stocks can generate way higher returns than mutual funds but also require monitoring regularly. Stocks like Asian Paints, Eicher Motors, and Infosys have created huge wealth for their shareholders since their IPO (Initial Public Offering).

Mutual funds returns are lower but more stable. It is advised to go with a direct mutual fund plan rather than a regular mutual fund plan to avoid commission fees.

3. Tax Implications

Tax implications play a very important role when deciding to invest between stocks and mutual funds. Losses incurred can also be used to reduce the tax liability. The tax implications for both are mentioned in the table below.

Investing in Mutual Funds vs Stocks? How to Choose

Invest in Mutual Funds If:

- You prefer passive investing with professional management.

- You want diversification with lower risk.

- You have long-term financial goals like retirement planning.

- You want to invest through SIP (Systematic Investment Plan) for cost averaging.

Invest in Stocks If:

- You have market knowledge and can fundamentally analyze individual stocks.

- You are willing to take higher risks for potentially greater returns.

- You have time to actively monitor and manage your investments.

- You prefer direct ownership of assets in this case equity stocks.

Final Thoughts

Both mutual funds and stocks come with their advantages and disadvantages. It is up to individual investors how they make their investments. A wise investor must have a combination of both stocks and mutual funds to enjoy the benefit of both investment options. A proper risk management strategy should be considered before investing in any particular asset class.

Investing in Mutual Funds vs Stocks Which is Better FAQ

Both stocks and mutual funds are good for investing when it comes to a long-term period of around 10-20 years. In this period, both can give good returns to investors.

Mutual funds hold a variety of stocks across different sectors which makes them diversified. This makes them a safer investment option than stocks.

Of Course. A good combination of stocks and mutual funds can potentially generate high returns with less risk.

Potentially stocks can generate multifold returns if selected correctly in comparison to any mutual fund. Mutual funds returns are less but the risk is also comparatively low.

Beginners may find mutual funds a safer option, while experienced investors can explore direct stock market investing.